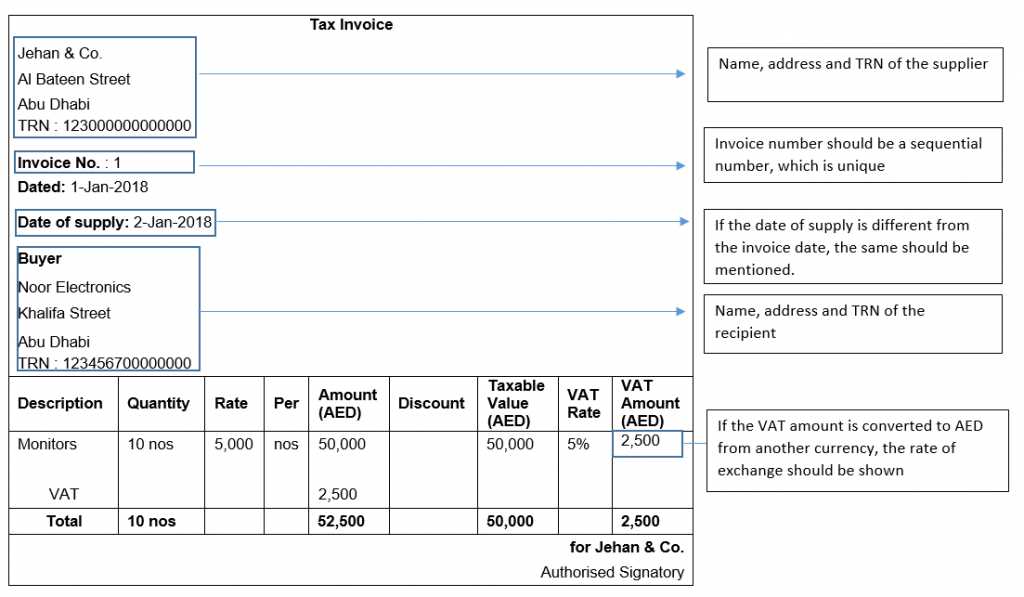

Tax Invoices Issued in Foreign Currencies

The required contents of a tax invoice issued in foreign currencies will be as follows:

- the tax amount payable expressed in AED.

- the exchange rate applied (as per the exchange rates published by the UAE Central Bank on the date of supply).

Rounding on Tax Invoices

Where a tax invoice is required to be issued and the tax chargeable on the supply is calculated as a fraction of a Fils, the value may be rounded to the nearest Fils on a mathematical basis.

Given that the tax amount should be calculated on a line by line basis on a full tax invoice as mentioned above, in practice this means that such rounding, if performed, should also be undertaken on a line by line basis.

By rounding the value on a mathematical basis, it is meant that the tax value stated on the tax invoice should be rounded to the nearest whole Fils (i.e. to 2 decimal places) by applying mathematical logic.

For example:

2.357 AED would become 2.36

9.862 AED would become 9.86

VAT will be charged on the value which is arrived after considering the discount. VAT will be charged on the prices after giving the discount.

The discount will be allowed to be reduced from the value of supply only if the following conditions which are prescribed in UAE VAT Executive regulations are met:

- The customer has benefited from the reduction in price

- The supplier funded the discount

For example, the value of supply is AED 10,000 and discount is AED 500. In this case, the value of supply will be AED 9,500 which is arrived after considering the discount value. VAT will be charged on AED 9,500.

Xact Auditing will take care of all the concerns related to VAT and provide you advises in light of latest changes in VAT rules and regulation. Let Xact help you while dealing with your tax matters, Contact us.

Xact Services