Corporate Tax Registration Services in UAE

Corporate Tax Registration Services in UAE

Xact Auditing is providing best corporate tax registration services in UAE to get the corporate tax registration number and certificate from FTA. Portal for registration is now open in Emaratax for all businesses in UAE. As per UAE CT law, all taxable businesses in UAE are required to register for corporate tax and obtain a corporate income tax registration number.

How to register for UAE Corporate Tax?

The steps for UAE corporate tax registration are as follows:

Step 1 : The first step is to create an account on Emaratax by registering with your email address and phone number or logging in using your existing credentials.

Step 2 : Create a taxable person or select a taxable person from the list.

Step 3: The third step is to register for CT. Please select this option and complete the registration process.

Requirements for Corporate Tax Registration

For UAE CIT Registration, businesses must submit all the necessary documents to FTA. The process will be done online. Following documents are required for Corporate Tax Registration in UAE.

In case of applicant is a Natural person

- Trade license – if applicable

- Passport and Emirates ID of the applicant

In case of applicant is a Legal Persons

- Trade license

- Passport and Emirates ID of authorized signatory

- Proof of authorization for the authorized signatory.

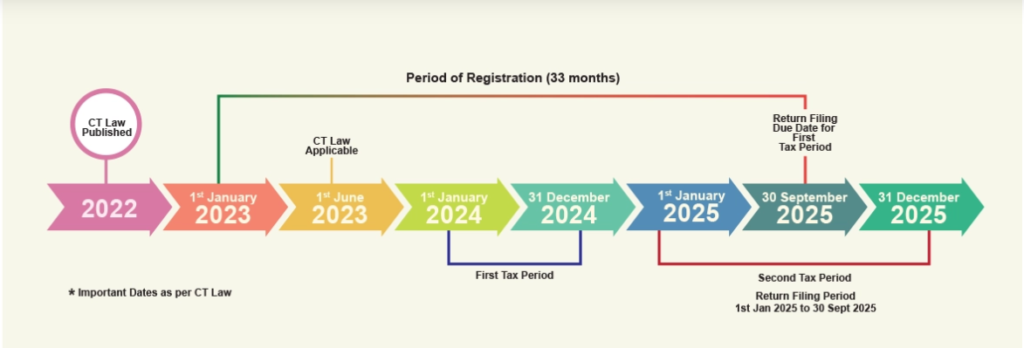

Corporate Tax Registration Timeline

A taxable business has until the date of their first tax return to register, according to the Federal Tax Authority (FTA). In the case of a taxable business whose year ends on May 31st, there is a 26-month registration period available until February 28th, 2025. For taxable businesses with financial year ends on December 31st, a 33-months registration period is available until 30th September, 2025.

FTA has announced corporate tax fines and penalties in UAE for violations of the UAE corporate tax laws.

Best Corporate Tax Consultants in Dubai

From June 1, 2023 – UAE companies will be subject to corporate income tax. It is important to understand the administrative requirements for corporate tax registration, deregistration, returns, and tax payment in order to prepare for these new regulations. The best corporate tax services in UAE are provided by Xact Auditing.

For hassle free corporate tax registration services in UAE, Contact us.

Xact Services