Tax Credit Note under VAT in UAE

What is Tax Credit Note under VAT in UAE?

Tax credit note under VAT in UAE are extremely important to ensure compliance and maintain proper books of accounts of the company. A Tax Credit Note can be of different formats, it can be a written document or an electronic document to be issued and recorded by a registered supplier of goods or services to record the following incidents:

- Supplies are returned or found to be deficient by the recipient

- Decrease in value of supply

- Decrease in value of tax

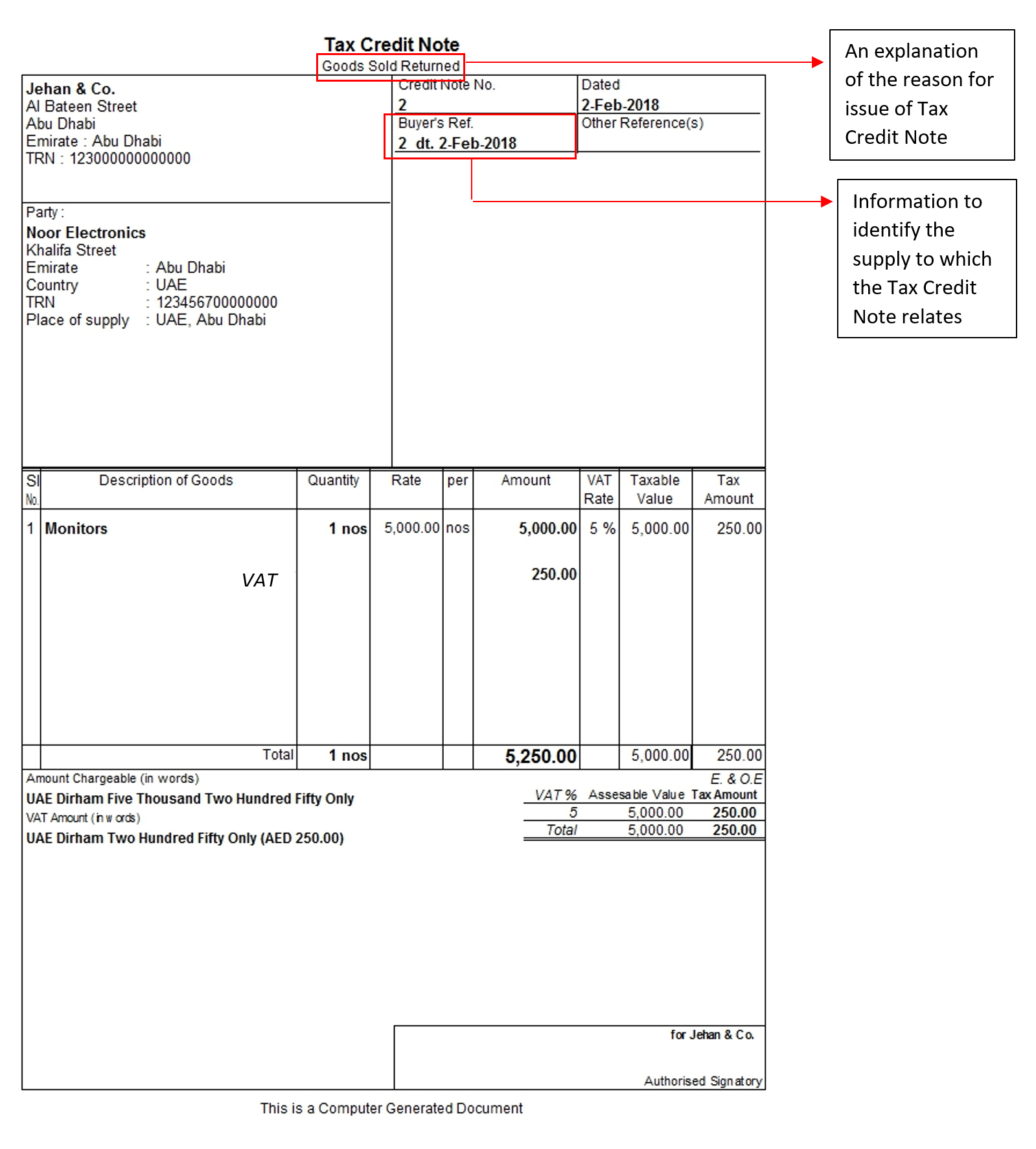

Example: On 2nd Feb, ’18, Jehan Trading Company., a registrant in Abu Dhabi, supplies 10 Monitors at the price of AED 5,000 each, to Noor Electronics, a registrant in Abu Dhabi. VAT charged on the supply is AED 2,500. On the same day, Noor Electronics returns 1 monitor to Jehan & Co., as it was found to be damaged in transit. In this case, Jehan Trading Company, should issue a tax credit note to Noor Electronics for the monitor returned and reverse the VAT charged on the monitor. The Tax Credit Note to be issued by Jehan credit note. is shown below.

Tax Credit Note format

A sample format of a Tax Credit Note under VAT in UAE is given below:

What Should a Tax Credit Note Contain?

As per the requirements of Federal Tax Authority (FTA), tax credit note must contain the following particulars:

- The words ‘Tax Credit Note’ should be clearly written on the invoice

- Tax Credit Note should contain the name, address, Tax Registration Number (TRN) of the registrant who makes supply

- Name, address, and TRN of the Recipient

- The issuance date of the tax Credit Note

- Details such as the value of supply as per the Tax Invoice, the exact amount of the supply’s value, the difference between the two values, and the tax charged in relation to that difference in AED

- A brief note explaining the circumstances that caused the issuance of the Tax Credit Note

- Information to identify the supply to which the Tax Credit Note is related

Impact of Tax Credit Note

A Tax Credit Note issued by a registered supplier will have 2 impacts:

- Reduction in tax payable by the supplier on the supply

- Reduction in input tax recoverable by the recipient on the supply

Electronic Tax Credit Note

A Taxable Person can issue a Tax Credit Note using electronic means, provided:

- The Taxable Person must be capable of securely storing a copy of the electronic Tax Credit Note as per the record keeping requirements

- The authenticity of origin and integrity of the content of the electronic Tax Credit Note should be guaranteed.

If the Tax Credit Notes are issued using electronic means, it is essential that all the required conditions for issue of Electronic Tax Credit Notes are fulfilled. Tax Credit Notes are also of great importance to recipients of supply who are registered, as a Tax Credit Note results in a corresponding reduction in their input tax recoverable on the supply.

Is It Compulsory to Issue A Tax Credit Note?

If the reduction or cancellation of a taxable supply is impacting the Tax Invoice issued earlier, the VAT registrants are mandated to issue a Tax Credit Note to cancel out the VAT that has been charged. However, the FTA may decide against the issuance of a Tax Credit Note under VAT in UAE for certain circumstances.

If the VAT registrant is able to show enough records to verify the particulars of any supply and prove that it is impractical to issue a Tax Credit Note, then the FTA will issue any of the following decisions:

- Exception from mentioning any one or more particulars that a Tax Credit Note is normally required to contain

- The taxable person is not required to issue a Tax Credit Note

Can a Recipient of Goods or Services Issue a Tax Credit Note?

In normal conditions, a supplier is the one who issues the Tax Credit Note. But a recipient can also raise a tax credit note as per FTA. Following are the conditions:

- The recipient of the Goods or Services is a VAT Registrant in the UAE

- The supplier and the recipient agree that the supplier won’t issue a Tax Credit Note

- The Tax Credit Note should contain all the required particulars

- The words ‘Tax Credit Note created by buyer’ should be displayed clearly on the Tax Credit Note

Conditions for Raising Electronic Tax Credit Note

- Taxable person is able to securely keep the copy of the electronic Tax Credit Note in compliance with the UAE VAT Law

- Taxable person can guarantee the authenticity of origin and content of the electronic Tax Credit Note

Seek the advice of Best Tax Consultants in Dubai

Businesses in UAE are required to consider the Tax Credit Note with ample focus and attention in order to ensure tax compliance with the FTA laws. To ensure that businesses in UAE are complying with the FTA regulations, the registered suppliers and recipients need to seek the advice of the best Tax consultants in Dubai such as Xact Auditing.

Our Services

Previous Post

Previous Post Next Post

Next Post