How to make Tax payments to FTA in UAE

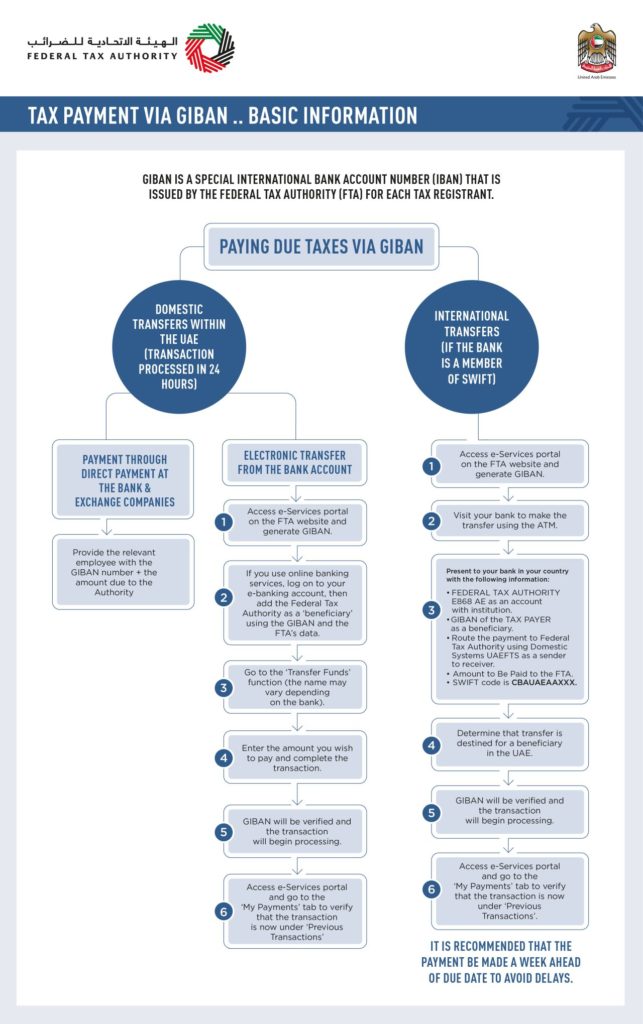

How to make tax payments to FTA in UAE is a question asked by many companies. After completing the VAT return filing process, companies are supposed to pay VAT to the Federal Tax Authority (FTA). There are several ways to make VAT and excise tax payments to the FTA in UAE.

How to make VAT payment to FTA?

In order to make a payment, you should return to the eServices portal and navigate to the tab called ‘my payments’. From there you will able to find out the amount of your VAT or excise tax liabilities. On the FTA portal, you can enter the amount you would like to pay into the box and click ‘Make a payment.

How to pay tax to FTA?

Federal Tax Authority (FTA) has given three different options to pay the tax liabilities:

1. Through exchange companies

2. Through E-dirham, Credit or Debit card (VISA or Master Card)

3. Through bank transfer (local transfer & international transfer)

How to make a tax payment to FTA through exchange companies?

Companies in UAE can make tax payments to the FTA by visiting the nearest exchange such as the Al Ansari exchange or the UAE exchange.

Companies need to present the following information to the exchange in order to pay the tax liability through the exchange:

1. GIBAN

2. Tax Registration Number (TRN)

3. Amount payable

Paying tax through the exchange is the cheapest method but companies must pay the tax liabilities through exchanges at least 2 days prior to the deadline. Because it will take approximately 48 hours for the exchange to process the payment and reflect it in the FTA account.

How to make a tax payment to FTA through an e-Dirham Card or Credit / Debit card?

Companies can also pay tax through an e-Dirham card or credit/debit card (VISA or MasterCard). It is the simplest and quickest way to pay the tax moreover it is also a good option for the companies who are paying their liabilities in the last minutes.

Payment through an e-Dirham card will incur a small amount of AED 3 whereas payment through credit/debit card will incur 2-3% of the total payable amount.

How to make a tax payment to FTA through bank transfers (local and international transfers)?

Local transfer using GIBAN

- Access the e-Services portal on the FTA website and generate GIBAN.

- If you use online banking services, log on to your e-banking account, then add the Federal Tax Authority as a ‘beneficiary’ using the GIBAN and the FTA’s data.

- Go to the ‘Transfer Funds’ function (the name may vary depending on the bank).

- Enter the amount you wish to pay and complete the transaction.

- GIBAN will be verified and the transaction will begin processing.

- Access the e-Services portal and go to the ‘My payments’ tab to verify that the transaction is now under ‘Previous Transactions’.

International transfer using GIBAN

If the companies are outside UAE and have their bank outside the UAE and the member of SWIFT, then they can visit their bank and make the tax payment to FTA.

- Access the e-Services portal on the FTA website and generate GIBAN.

- Visit your bank to make the transfer using the ATM.

- Present to your bank in your country with the following information:

1. GIBAN of the taxpayer as a beneficiary

2. Federal Tax Authority E868 AE as an account with an institution.

3. Route the payment to FTA using domestic systems UAEFTS as a sender to receiver.

4. Amount to be paid to the FTA in AED (Dirhams)

5. SWIFT code is CBAUAEAAXXX.

It is recommended that the international transfers via GIBAN must be made a week ahead of the due date to avoid VAT fines and penalties. Xact Auditing is a registered tax consultant and we will take care of all the concerns related to VAT and provide you advice in light of the latest changes in VAT rules and regulations. Let Xact Auditing help you while dealing with your tax matters, contact us.

Xact Services

Next Post

Next Post