Why Small Businesses need Outsourced Accounting in UAE?

Discover how outsourced accounting in UAE helps small businesses cut costs, stay compliant, and focus on growth with expert financial support. Xact Auditing is one of the top accounting firms in UAE.

Running a small business in the UAE is exciting, but it is not easy. Every dirham matters, and so every hour too. Deadlines for VAT and corporate tax filings keep coming.

Rules change fast, and a small mistake can cost more than you expect. That is why more business owners are looking for a smarter way to manage their numbers.

The answer is simple: outsourced accounting. It is one of the fastest ways to cut costs, stay compliant, and keep your focus on growth. In 2025, when compliance costs in the UAE are higher than ever, having the right partner for your bookkeeping services in UAE is not a luxury. It is a necessity.

What is Outsourced Accounting in UAE?

Outsourced accounting means hiring an external team to do your bookkeeping and tax work. You do not employ full-time staff. You pay only for what you use. That saves overhead. That saves time.

You get trained pros who know the 2025 UAE accounting services rules. You get help with VAT compliance under the Federal Tax Authority. You get accurate work and fewer mistakes.

Key Ways Outsourced Accounting Helps You Cut Costs

1. Lower Overhead

You do not pay a salary. You do not pay benefits. You do not pay leave or insurance. You just pay for the tasks you need. That can be up to 50 percent less than having an in house accountant. You save on office space and software too.

2. Pay for What You Need

Each business has its own rhythm. Some need help only a few hours a week. Some need full monthly accounting and bookkeeping services in UAE to close work. With bookkeeping outsourcing, you can scale. You pay more when work is high. You pay less when things slow. You avoid paying for idle time.

3. Avoid Compliance Fines

VAT regulations in the UAE are still strict in 2025. A small error in VAT return filing can cost thousands in fines. With external accounting teams, you get experts who keep up to date on rules. You get correct VAT returns. You stay safe. You avoid costs that come from errors.

4. Save Time and Focus on Your Business

When you outsource accounting tasks, you save time. You can concentrate on your essential tasks. You can work on sales. You can work with customers. That can improve your revenue. A small firm might gain back 10 to 20 hours a month. That can raise profit by 5 to 10 percent.

5. Better Cost Forecasting

With professionals handling your books, you get clear reports. You see cash flow each month. You see where costs are rising. You can act early. That avoids surprises like late vendor bills. That helps you save on fees and late charges.

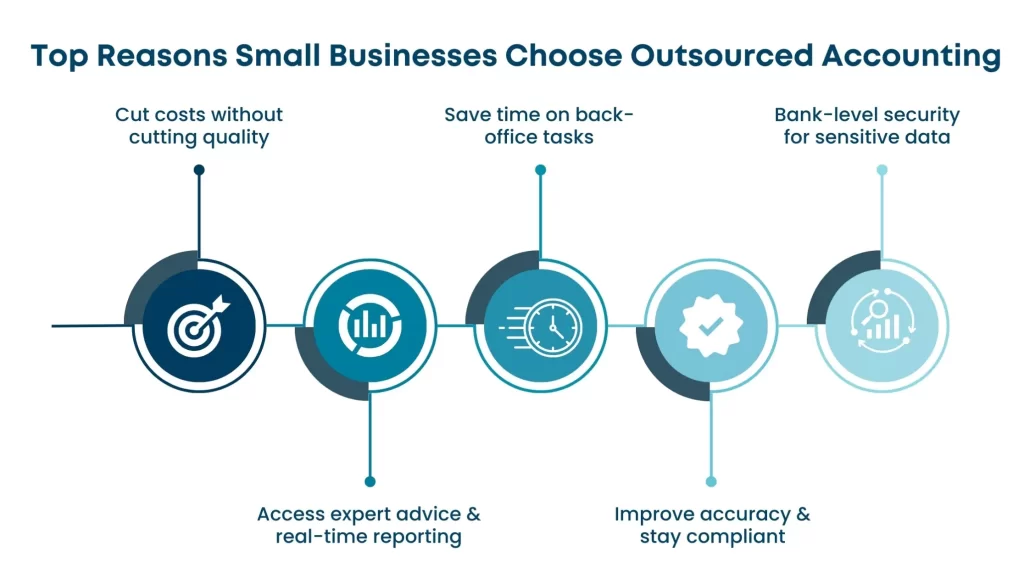

Why Small Businesses in UAE Should Choose Outsourced Accounting?

When you look at the numbers and the time saved, the benefits become clear.

- You spend far less on staff because you are not paying a full salary year-round.

- There is no need to set aside extra space in your office or pay for costly accounting software.

- The billing can rise or fall depending on the amount of work you have that month.

- Your VAT returns are filed correctly, which keeps you safe from penalties.

- You have more hours in the week to work on your products, services, or clients.

- Monthly reports give you a clear picture of your cash flow and spending.

- If you are close to the UAE VAT threshold, your accountant can warn you in time to avoid trouble.

Most small businesses in the UAE leave VAT and corporate tax planning until year-end. That can lead to big tax bills. With UAE accounting services experts, you get a VAT threshold tracking service. In 2025, the standard VAT threshold is AED 375000. That means you must register when your revenue crosses that mark.

The outsourcing team can track your run rate. They can alert you early. You can choose to register on time. You avoid VAT fines and corporate tax finea or retroactive tax charges. That can save thousands of UAE dirhams each year.

How Xact Accounting Brings Value in 2025

Xact Auditing brings deep UAE expertise and knows the local audit and accounting landscape inside out. We manage VAT compliance under FTA rules with accuracy and care. We deliver small business accounting outsourcing that is precise and dependable.

Our services include accounting, bookkeeping, digital accounting, backlog accounting, VAT accounting, Corporate tax accounting and much more. To guarantee a seamless start, we have a defined client onboarding process in place. We prioritize quality above quantity, resulting in fewer errors, faster month-end closing, and consistent cost savings for your organization.

How to Choose the Right Partner for Accounting?

Ask These Questions

- Do they know UAE VAT rules?

- Do they track the VAT threshold early?

- Do they offer flexible plans that match your workload?

- Do they show reports that help you forecast costs?

- Do they free up your time for business work?

Look for These Signs

- Transparent pricing

- Clear process steps and timelines

- Local presence and support

- Skilled staff who know UAE audit and tax law

- Evidence of error control, like audit trails

Focus on Business Growth While We Handle Your Accounts

Outsourced accounting is not just a way to cut costs. It is a way to work smarter. It gives you time back. It helps your business stay compliant in 2025. It improves how you see and manage your money.

For small businesses in the UAE, it is a wise choice. You get expert support. You keep your focus on growth and customers. You leave the accounting to the pros. And that makes all the difference.

If you are ready to make your accounting simple, accurate, and cost-effective, we at Xact Auditing are here to help. Let us handle your books so you can handle your business. Contact us today to get a clear plan, transparent pricing, and results you can trust.

Zuha is a content writer at Xact Auditing, specializing in UAE accounting, audit, VAT, and Corporate Tax content. She delivers research-driven, clear insights by simplifying complex regulatory and compliance topics for UAE businesses. Her work is developed in collaboration with chartered accountants and tax professionals, ensuring alignment with IFRS, ISA, and FTA regulations. Content is written by Zuha and reviewed by Xact Auditing’s audit, accountants and tax experts for accuracy and compliance.

Previous Post

Previous Post Next Post

Next Post