E-Invoicing in UAE 2026

E-invoicing will be mandatory in UAE by 2026. E-invoice is exchanged between supplier and buyer and reported electronically to Tax Authority. Running a business in the UAE has always meant keeping up with change. Now, another big shift is on the horizon: VAT e-invoicing will officially become mandatory on July 1, 2026.

What is an e-Invoice?

An e-invoice in UAE is a standardized, structured format of invoice data that is generated, transmitted, and received electronically between a supplier and a buyer. It is then directly reported to the UAE Federal Tax Authority (FTA). Unlike traditional methods, unstructured formats such as PDFs, Word files, scanned copies, images, or email attachments do not qualify as e-invoices under the UAE regulations.

How UAE e-invoicing system works?

The UAE’s e-invoicing model follows a structured process to ensure accuracy, transparency, and compliance with the Federal Tax Authority (FTA). The following steps provide a clear overview of how e-invoices are generated, exchanged, and reported within the system.

Supplier generates the invoice

- Suppliers will create invoice and enter invoice date into their accounting software like QuickBooks, Tally, ZohoBook or SAP. and initiates the invoicing process via Accredited Service Provider (ASP) such as OpenPeppol.

Validation by Accredited Service Provider (ASP)

- Instead of sending it straight to the customer, the invoice first passes through an Accredited Service Provider (ASP). It will validate invoice and ensure it follows the UAE’s e-invoicing standards.

Invoice Transmission

- After the verification, it will transmit invoice date to the buyer ASP ensuring compliance with PEPPOL standards. Invoices can be issued direct B2B.

Reporting to Federal Tax Authority (FTA) & Ministry of Finance (MoF)

- After all the verifications and compliance checks, ASP send the invoice to Federal Tax Authority (FTA) & Ministry of Finance (MoF) instantly.

Once approved, the invoice is already part of the FTA’s records. For businesses, that means fewer headaches around mistakes or customer challenges.

Consequences of Non-Compliance with UAE e-Invoicing

A lot of companies will delay preparations until the final stretch. The problem? That’s exactly when mistakes pile up, and the FTA won’t hesitate to issue fines. Here’s what can actually happen:

- You could end up with penalties if you miss the compliance rules; the FTA doesn’t really hand out grace periods.

- If an invoice gets rejected by the system, your payments may be delayed, and that hits your cash flow directly.

- When thousands of businesses all try to set up at the last minute, systems and providers get overloaded. That means slower support and more stress for your team.

- Staff stress from trying to learn new processes under pressure.

On the other hand, preparing early gives you time to test your systems, train your people, and fix issues calmly.

Scope of e-invoicing in the UAE

In its initial phase, the UAE’s e-invoicing system will apply to business-to-business (B2B) and business-to-government (B2G) transactions, irrespective of the VAT registration status of the parties involved. It is anticipated that the Ministry of Finance (MoF) may later extend the framework to cover business-to-consumer (B2C) transactions as well.

The e-invoicing system will apply to all taxpayers obligated to issue invoices under UAE VAT law. This encompasses businesses of all sizes; however, large taxpayers are expected to be among the first adopters in the initial rollout.

Smaller businesses will be phased in subsequently, with compliance thresholds likely determined by annual turnover over recent years.

VAT groups will also fall under the mandate, with each member required to establish a connection with an Authorized Service Provider (ASP) while using the group TRN, ensuring that all transactions are accurately captured within the e-invoicing framework.

What transactions will be covered in e-invoice?

a) Domestic Transactions

Under the initial mandate, e-invoicing will apply to business-to-business (B2B) and business-to-government (B2G) transactions. While business-to-consumer (B2C) transactions are expected to be included in later phases, they are not currently within scope.

For identification purposes, the Tax Identification Number (TIN)—the first 10 digits of the Tax Registration Number (TRN)—will serve as the business identifier. Accordingly, B2B transactions will fall under the framework regardless of VAT or Corporate Tax registration status, provided the counterparty is a business holding a valid TIN.

b) Export Transactions

Transactions with overseas customers will also be included within the e-invoicing framework. Overseas entities are not required to register with a UAE Authorized Service Provider (ASP) unless they have an obligation to register for VAT or Corporate Tax in the UAE.

For overseas customers already connected to the PEPPOL network in their home country, their PEPPOL address can be used for UAE e-invoicing purposes. In cases where the overseas customer is not part of the PEPPOL network, UAE businesses will continue to share invoices through traditional channels such as PDF documents via email, consistent with current practice.

Importance of July 2026 in UAE’s E-Invoicing Rollout

UAE government isn’t just switching formats for the sake of it. E-invoicing is designed to create a stronger, faster, and more transparent tax system. Here’s what that really means for businesses:

- The FTA will be able to see invoices in real time, which means fewer questions and back-and-forth during audits.

- Fake or inflated invoices become harder to slip through, so companies that follow the rules won’t be at a disadvantage.

- UAE is joining a trend that’s already working in Saudi Arabia and Egypt, so regional trade will feel more seamless.

- For companies, it’s also a chance to reduce manual mistakes and build trust with customers who know your invoices are verified.

Delaying prep usually backfires, and by the time you start, others will have their compliance sorted, and you’ll be playing catch-up.

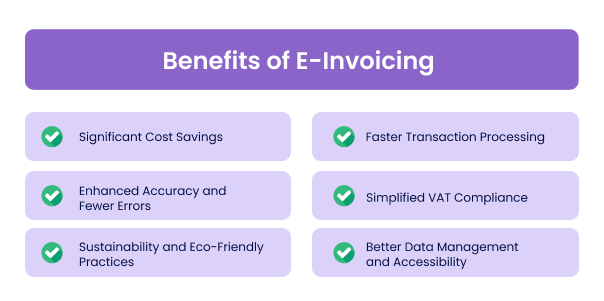

Benefits of e-invoicing

Most business owners hear “new mandate” and immediately think of extra hassle. Fair enough. But e-invoicing isn’t just about ticking a compliance box; it can actually make daily operations smoother:

- Payments often clear faster because clients see the invoice has already been validated by the FTA.

- Your team won’t waste as much time fixing mistakes or entering the same data twice.

- Because invoices go into the system straight away, you’ll get a better idea of cash flow without waiting until the books close.

- Businesses that move early often look more reliable to clients and suppliers; people notice when things run smoothly.

In short, while the law makes it compulsory, the side benefits can help modernize how your business runs.

How Xact Auditing Simplifies Your E-Invoicing Compliance

In the UAE, deadlines have a way of creeping up fast. July 2026 might sound far off today, but the companies that prepare early will move into e-invoicing without disruption. Those who leave it until the last-minute risk dealing with rejected invoices, cash flow hiccups, and possible fines.

At Xact Auditing, we’ve walked businesses through every major change so far, from the first days of VAT in 2018 to the recent corporate tax rollouts. We know where the usual roadblocks are, and we know how to set up systems that work smoothly with FTA requirements.

If you’d rather avoid the scramble later, now is the time to act. Reach out to Xact Auditing and let our team run a readiness check, connect your invoicing system, and get you comfortable with the new process well before 2026 arrives.

Zuha is a content writer at Xact Auditing, specializing in UAE accounting, audit, VAT, and Corporate Tax content. She delivers research-driven, clear insights by simplifying complex regulatory and compliance topics for UAE businesses. Her work is developed in collaboration with chartered accountants and tax professionals, ensuring alignment with IFRS, ISA, and FTA regulations. Content is written by Zuha and reviewed by Xact Auditing’s audit, accountants and tax experts for accuracy and compliance.

Previous Post

Previous Post Next Post

Next Post