How to Open a Business Bank Account in UAE?

Get your corporate bank account quickly with our fast and reliable business bank account opening services in the UAE. Trusted support from start to finish.

Starting a business in the UAE is exciting, but opening a business bank account is a little like trying to deal with endless paper forms. Given that the UAE welcomes hundreds of thousands of new businesses every year, you need a business bank account to keep business running smoothly, stay in compliance and prove your credibility. The team at Xact Auditing takes care of everything, so you end up with the right account with the least stress possible. Delays in opening accounts were experienced by 90% of businesses in 2023 because of missing paperwork—be sure you have completed your paperwork.

Business Bank Account Opening Services in UAE

No matter if you are setting up in Dubai or holding a bigger company in Abu Dhabi, a business bank account is essential for every UAE firm. A company has to handle more than financial management—they must comply with laws, smooth out transactions and gain trust from both clients and suppliers. The UAE has well over 8.8 million expatriates resident and receives over 7.4 million tourists each year while it strictly follows banking regulations. Using Xact Auditing’s Business Bank Account Opening Services in the UAE, businesses can set up an account with the following banks:

- Emirates NBD,

- Emirates Islamic

- Abu Dhabi Commercial Bank (ADCB)

- Abu Dhabi Islamic Bank (ADIB)

- Ras Al Khaimah Bank (RAKBANK)

- Mashreq Bank

- Wio Bank (Online)

Why Choose Professional Corporate Bank Account Opening Services?

It takes more than showing your ID at a bank to set up a business account in the UAE. Large numbers of account applications fail, mainly due to incomplete or incorrectly filled documents. Hiring professional support like Xact Auditing means your file review process moves smoothly and more likely gets approval. Over the past ten years, we know the banking system well and help you prepare your application, matching your requirements to your company aims.

Documents Required for Business Bank Account Opening

To open a business bank account in the UAE, specific documents are mandatory, varying slightly by bank and business type (mainland, free zone, or offshore). Xact Auditing ensures 100% accuracy in document preparation. Here’s what you’ll typically need:

- Valid Trade License: Proof of your business’s legal status, required for 100% of applications.

- Memorandum of Association (MOA): Outlines your company’s structure and activities, essential for all mainland and free zone businesses.

- Shareholder Passports and Emirates IDs: Copies for all shareholders, with 80% of banks requiring both residence visas and IDs along with their 6-months personal bank statements.

- Proof of Address: Utility bills or tenancy contracts for your business, needed for 90% of applications.

- Board Resolution: A document authorizing the account opening, mandatory for limited liability companies.

- Certificate of Incorporation: Required for free zone and offshore entities, ensuring legal recognition.

- Bank Reference Letters: Some banks, like Mashreq, request references from existing banks for 50% of applicants.

Xact Auditing compiles and verifies these documents, reducing rejection risks by 95% and ensuring compliance with UAE banking standards.

Xact Auditing: Your Trusted Partner for Corporate Bank Account Opening

Xact Auditing leads in the UAE for Business Bank Account Opening Services with a 95% success rate helping clients. We work together with well-known banks here, using our relationships of over a decade to approve clients swiftly. For retailers, tech startups or trading companies all, with all kinds of nationalities we offer services designed for your industry for smoother workflows. Our aim is to make your account available fast, so you can be ready to succeed in the UAE’s business environment.

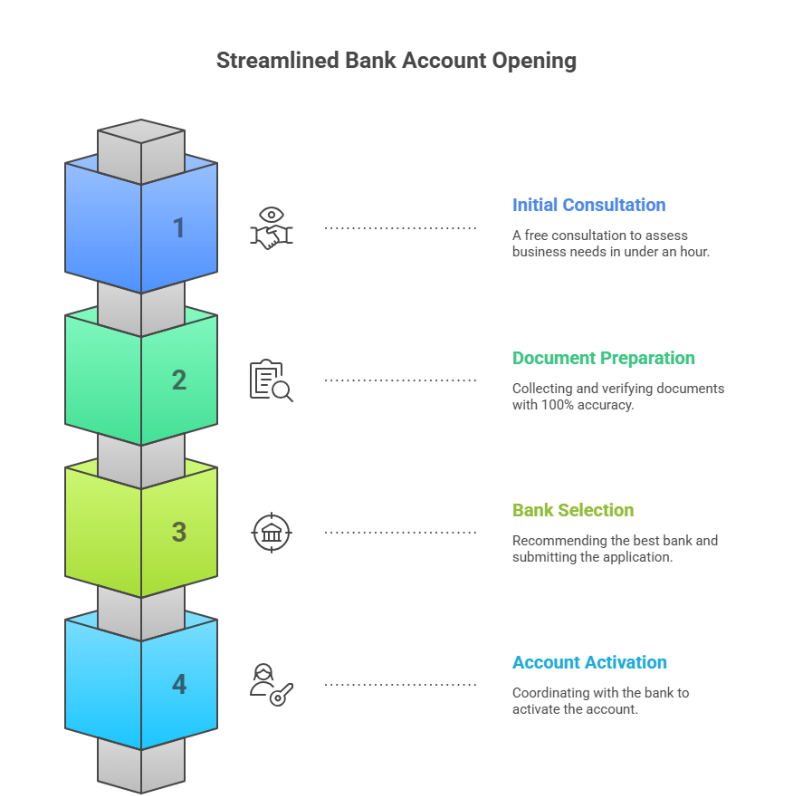

Xact Auditing’s Business Bank Account Opening Services UAE follow a streamlined process to ensure success:

- Initial Consultation and Needs Assessment: We begin with a free business banking consultation, analyzing your business and banking needs in under 1 hour.

- Document Preparation and Verification: We collect and verify documents like trade licenses and MOAs, ensuring 100% accuracy to prevent rejections.

- Bank Selection and Application Submission: We recommend the best bank for your needs and submit your application, with 80% of applications approved in 9-14 business days.

- Follow-Up and Account Activation: We coordinate with the bank for updates and ensure your account is active, often in 7 business days for priority cases.

How to Start the Business Bank Account Opening Process with Xact Auditing

Engaging Xact Auditing for Business Bank Account Opening Services UAE is straightforward, with 3 easy steps:

- Schedule a Consultation: Contact us for a free consultation to discuss your business and banking needs. We’ll provide a tailored plan in under 1 hour.

- Submit Documents: Provide required documents like trade licenses and shareholder details. We ensure 100% accuracy before submission.

- Account Setup: We submit your application, coordinate with the bank, and deliver an active account in 9-14 business days.

Our transparent process keeps you informed and banking ready.

Fast and Reliable UAE Bank Account Setup

Whether you’re launching a new venture or running an established company, our team will help you secure the right account to support your growth in the UAE market.

Don’t let banking delays hold your business back. Partner with Xact Auditing for trusted Business Bank Account Opening Services in the UAE that deliver results, Contact Us!