E-Invoicing Services in UAE

Simplify your tax and invoicing process with our expert E-Invoicing Services in UAE. Stay compliant with FTA requirements using fast, secure, and fully automated e-invoice solutions tailored to your business.

If you have a small business in the UAE, you probably know there are days it’s exciting and days it’s just… stressful. You have invoices to send, payments to chase, VAT rules to follow, and on top of that, you just want your business to grow.

Have you heard about e-invoicing? If not, now is a great time to pay attention because it is changing the way businesses handle their invoices, and honestly, it makes life a lot easier.

What is E-Invoicing?

E-invoicing might sound fancy, but it is really just sending invoices digitally in a structured format approved by the UAE Federal Tax Authority. Instead of printing papers or sending PDFs and hoping everything is correct, e-invoicing is automated and validated for accuracy.

For small business owners, this is not just about following the rules. It actually:

- Saves a lot of time

- Reduces mistakes

- Keeps cash flow smoother

- Makes audits less stressful

A firm like Xact Auditing can help small businesses set up e-invoicing so that everything ticks the boxes for FTA compliance without giving you a headache.

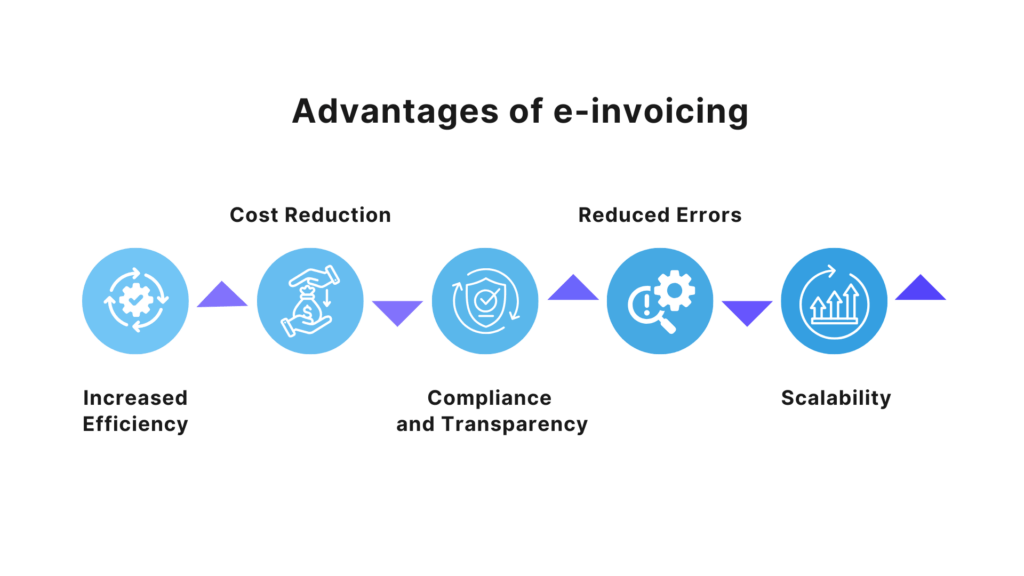

Benefits of E-Invoicing for UAE Businesses

Still wondering if e-invoicing is really necessary for your small business? Honestly, it is. Even if your current system “works,” switching can actually make your life a lot simpler. Here’s what business owners in the UAE are noticing when they make the jump:

- Save Time Every Week

Let’s face it! Manual invoicing is a bit of a nightmare. Drafting invoices, double-checking numbers, chasing clients for payments, it takes forever. E-invoicing does a lot of this automatically, which is a lifesaver.

For example:

- The system can fill in invoice details for you

- You can send invoices straight to clients without printing or emailing PDFs

- It keeps track of who has paid and who hasn’t, so no more constant follow-ups

Think about all the hours you’ll get back. Hours you can spend actually growing your business instead of staring at spreadsheets.

- Fewer Mistakes, Less Headache

We’ve all been there – sending an invoice with the wrong total or VAT calculation and then waiting nervously for a client to notice. It’s stressful.

E-invoicing takes a lot of that stress away:

- It checks calculations automatically

- It ensures customer info is correct

- Reduces human errors significantly

So, you can relax a bit, knowing that your invoices are accurate most of the time. It’s like having a safety net for your accounting.

- Quicker Payments and Smoother Cash Flow

Cash flow is everything for a small business, you know? If a client delays payment, it messes with your whole schedule. E-invoicing can actually help with this.

- Clear invoices get processed faster

- Payments come in sooner, usually without a lot of chasing

- You get a better sense of what money is actually coming in

Honestly, faster payments mean you can breathe a little easier and plan your next steps without constantly stressing about cash.

- Compliance Without the Stress

Let’s be honest, the UAE FTA rules are easy to get wrong. And if you do, it can be expensive. E-invoicing makes it a lot less stressful.

- It sticks to the FTA format, so you are on the safe side

- Invoices are stored safely, just like the rules say

- You have a clear trail if anything ever comes up in an audit

With Xact Auditing helping out, you do not have to figure all this out yourself. We are there to guide you and make sure nothing slips through the cracks.

- Save Money and Go Green

Paper invoices aren’t just annoying; they cost money and take up space. Going digital is better for your wallet and for the planet.

- Less spending on printing and storage

- No more piles of paper cluttering your office

- Shows clients that your business cares about the environment

Even small changes like this can make your business feel more professional and forward-thinking, without too much effort.

How to Implement FTA-Compliant Digital Invoicing?

Getting started with e-invoicing is not as scary as it sounds. You don’t have to do it all at once. Here’s a simple way to take the first step:

- Check how you currently handle invoices

- Pick an FTA-approved e-invoicing software

- Train your team to use it properly

- Work with us at Xact Auditing to make sure everything is done right

Why Choose Xact Auditing for E-Invoicing?

Switching to e-invoicing can feel tricky sometimes. We know that there are rules, VAT format, and all the technical stuff that can get confusing. That is why we are here. At Xact Auditing, we help small businesses in the UAE get it right without making it a headache.

Here’s what we do to make it easier for you:

- We make sure your invoices follow FTA rules so you do not run into problems later

- Xact helps you avoid mistakes that can slow down payments

- We guide you whenever you get stuck or have questions

With us handling the tricky technical stuff, you can finally focus on your business and stop stressing over invoices all the time.

Expert Implementation & Ongoing Support

E-invoicing is not just another rule to follow. Think of it as a tool that actually makes your workday smoother. It saves time, reduces mistakes, speeds up payments, and even cuts down on paper. Businesses in the UAE that start using it early notice the difference pretty quickly.

If you are still using paper or manual invoices, it is probably time to rethink your process. When you work with us at Xact Auditing, we make the whole thing simple and stress-free. Honestly, once you get started, you might wonder why you didn’t switch sooner! So, contact Xact now and make your process smoother and professional!

Zuha is a content writer at Xact Auditing, specializing in UAE accounting, audit, VAT, and Corporate Tax content. She delivers research-driven, clear insights by simplifying complex regulatory and compliance topics for UAE businesses. Her work is developed in collaboration with chartered accountants and tax professionals, ensuring alignment with IFRS, ISA, and FTA regulations. Content is written by Zuha and reviewed by Xact Auditing’s audit, accountants and tax experts for accuracy and compliance.

Previous Post

Previous Post Next Post

Next Post