Accounting Services for Free Zone Companies

Xact Auditing provide high-quality accounting services for UAE free zone companies. Our chartered accountants assist with data management, financial analysis, and the preparation of financial statements.

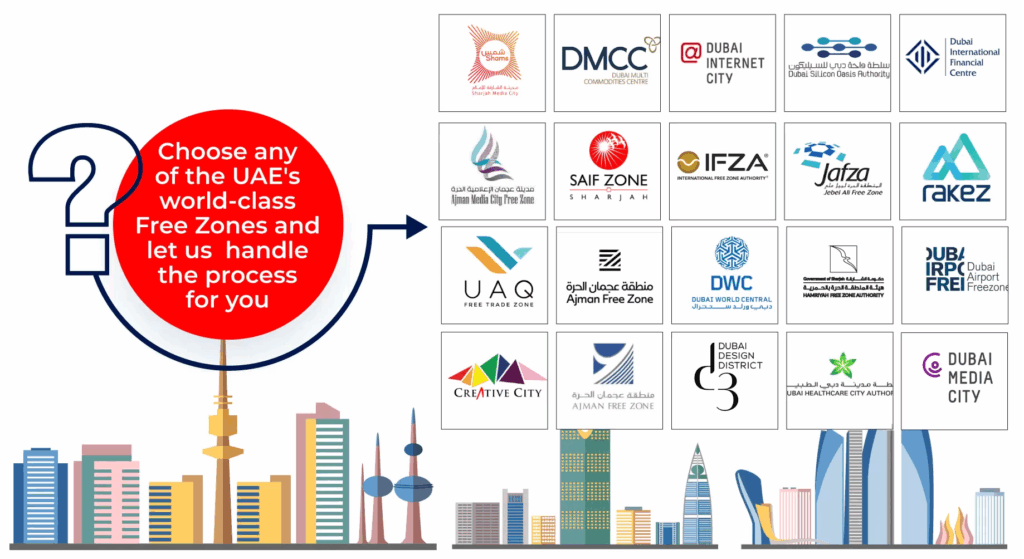

Setting up a company in a UAE free zone can feel like hitting two birds with one stone. You enjoy full foreign ownership, potential tax benefits, and access to world-class infrastructure. But here’s the thing: the accounting side often catches people off guard. That’s where firms like Xact Auditing come in to guide you through the finer details.

Why Free Zone Companies Need Expert Accountants?

When your business is based in a free zone, you’re not just dealing with regular bookkeeping. There are extra layers of rules, and missing any of them can be costly.

Regulatory obligations

- Free zone authorities often require annual audited financials, even if you’re a small outfit.

- VAT and customs-related matters can be complex when you trade within the zone, with the mainland, or overseas.

- With new corporate tax rules, you’ll want someone who keeps up so you don’t face unexpected liabilities.

Operational-business matters

- Your transactions might involve multiple environments: exports, imports, and intra-zone transfers. This makes bookkeeping more than just receipts and invoices.

- As you grow, currency exposures and conversion issues may arise. If you’re working with stock, imports, or cross-border services, your financial system needs to handle that smoothly.

- Many business owners focus on launching the venture and forget that a clean accounting setup at the start means fewer headaches later.

Tailored Accounting Solutions for Free Companies in UAE

You will need a full-accounting service approach, especially from a team that gets free zones. Here’s what to look for (and what we deliver at Xact Auditing).

Bookkeeping & accounting system setup

A good provider will:

- Set up your chart of accounts and transactions to match your license type and activities

- Help you implement cloud-based accounting software so you can access the figures anytime

- Reconcile bank accounts, track vendor purchases, and maintain accurate asset registers

VAT, customs & tax compliance

Since free zones often tie into import/export, your accounting partner should:

- Support VAT registration and VAT filing

- Help classify transactions correctly (zone-to-zone, mainland, overseas)

- Monitor tax changes (for instance, the UAE corporate tax rules) so you are ahead of the curve

Even smaller free-zone companies may need:

- End-of-year audit readiness (or full statutory audit)

- Financial statements prepared according to UAE reporting standards

- Support in submitting reports to regulators and free zone authorities

Advisory for growth

What sets a firm apart is offering more than compliance. At Xact Auditing, we also focus on:

- Budgeting and forecasting so you know where you are heading

- Cost-control advice when importing or exporting goods or services

- Support when you expand from one free zone to another or into the mainland

Why Businesses Trust Xact Auditing for Free Zone Accounting Solutions?

Here’s what makes us different and why your free-zone business wins:

- Deep experience in UAE free zones: we’ve worked across various zones, so we know the quirks and rules.

- Tailored approach: rather than a one-size-fits-all service, we build your accounting setup to match your license, sector, and scale.

- Transparent support: you get monthly reports, clear advice, and no hidden surprises at year-end.

- Focus on value: we aim to go beyond just checking boxes. We help you leverage your financials for growth, not just compliance.

Essential Insights to Help Free Zone Companies Stay Ahead

- Start early: Even before your license is issued, think about your accounting setup; it saves time and money later.

- Keep data organized: Import/export records, currency tables, vendor contracts — all matters.

- Review licenses regularly: If your business activity changes, you may need to adjust your accounting setup accordingly.

- Use cloud software: Free zone accounting often means multi-jurisdiction transactions, and cloud systems help you track from anywhere.

- Speak up if you expand: Moving from one free zone to another, or trading more with the mainland, changes your financial picture and risks.

Contact Xact Now!

Free zone companies in the UAE enjoy huge advantages, but the accounting side matters. Get it wrong and those benefits can be eroded by penalties, mistakes, or inefficient systems.

By partnering with an accounting firm like Xact Auditing, you give yourself the best chance of staying compliant, organized, and ready to grow. Let your business focus on what you do best while your accounting partner works behind the scenes. Ready to talk? Let’s get started.

Zuha is a content writer at Xact Auditing, specializing in UAE accounting, audit, VAT, and Corporate Tax content. She delivers research-driven, clear insights by simplifying complex regulatory and compliance topics for UAE businesses. Her work is developed in collaboration with chartered accountants and tax professionals, ensuring alignment with IFRS, ISA, and FTA regulations. Content is written by Zuha and reviewed by Xact Auditing’s audit, accountants and tax experts for accuracy and compliance.

Previous Post

Previous Post Next Post

Next Post